Gambling.com Group - Strong Buy

Investment Thesis

Gambling.com Group Limited (NASDAQ: GAMB) is a premier performance marketing company in the online gambling industry, operating a high-margin, asset-light digital media business. The company specializes in generating high-intent traffic and leads for regulated online gaming operators, leveraging proprietary technology, SEO expertise, and strategic acquisitions to drive sustainable growth. With consistent revenue expansion, high EBITDA margins, and strong free cash flow generation, GAMB is positioned as a market leader in the growing global iGaming and sports betting sectors.

Key reasons for our Strong Buy rating:

Sustained revenue growth: 36.9% YoY increase in Q3 2024 revenue, fueled by market share gains.

High-margin business model: Q3 2024 adjusted EBITDA grew 108% YoY, with 39% EBITDA margins.

Capital efficiency and FCF strength: Record $14.2M in free cash flow in Q3 2024, supporting buybacks and M&A.

Scalable international expansion: Rapid growth in the UK, Ireland, and broader European markets.

Robust balance sheet: Strategic M&A and share repurchases demonstrate management's capital allocation discipline.

GAMB’s highly differentiated competitive position, disciplined execution, and strong exposure to long-term digital gaming tailwinds make it an attractive investment at current levels.

Company Overview

Gambling.com Group operates a network of performance marketing websites that drive high-value traffic to online gambling operators. The company monetizes traffic primarily through cost-per-acquisition (CPA) and revenue-shareagreements. With leading brands like Gambling.com, Bookies.com, and Casinos.com, GAMB has built a strong reputation for delivering top-tier, high-intent customers to gaming operators.

Market Position & Competitive Advantage

Deep SEO & content expertise: GAMB ranks among the most efficient performance marketing platforms in the industry, allowing it to capture organic search traffic at scale.

Diverse geographic footprint: Significant presence in North America, the UK, and European markets.

Proven M&A strategy: The Freebets.com acquisition has been successfully integrated, adding meaningful revenue and market expansion opportunities.

Strategic share repurchases: 8% of outstanding shares repurchased since 2022, underscoring management confidence.

With tailwinds from iGaming legalization, continued digital advertising growth, and disciplined execution, GAMB is well-positioned to outperform competitors and continue delivering double-digit revenue growth.

Financial Performance & Earnings History

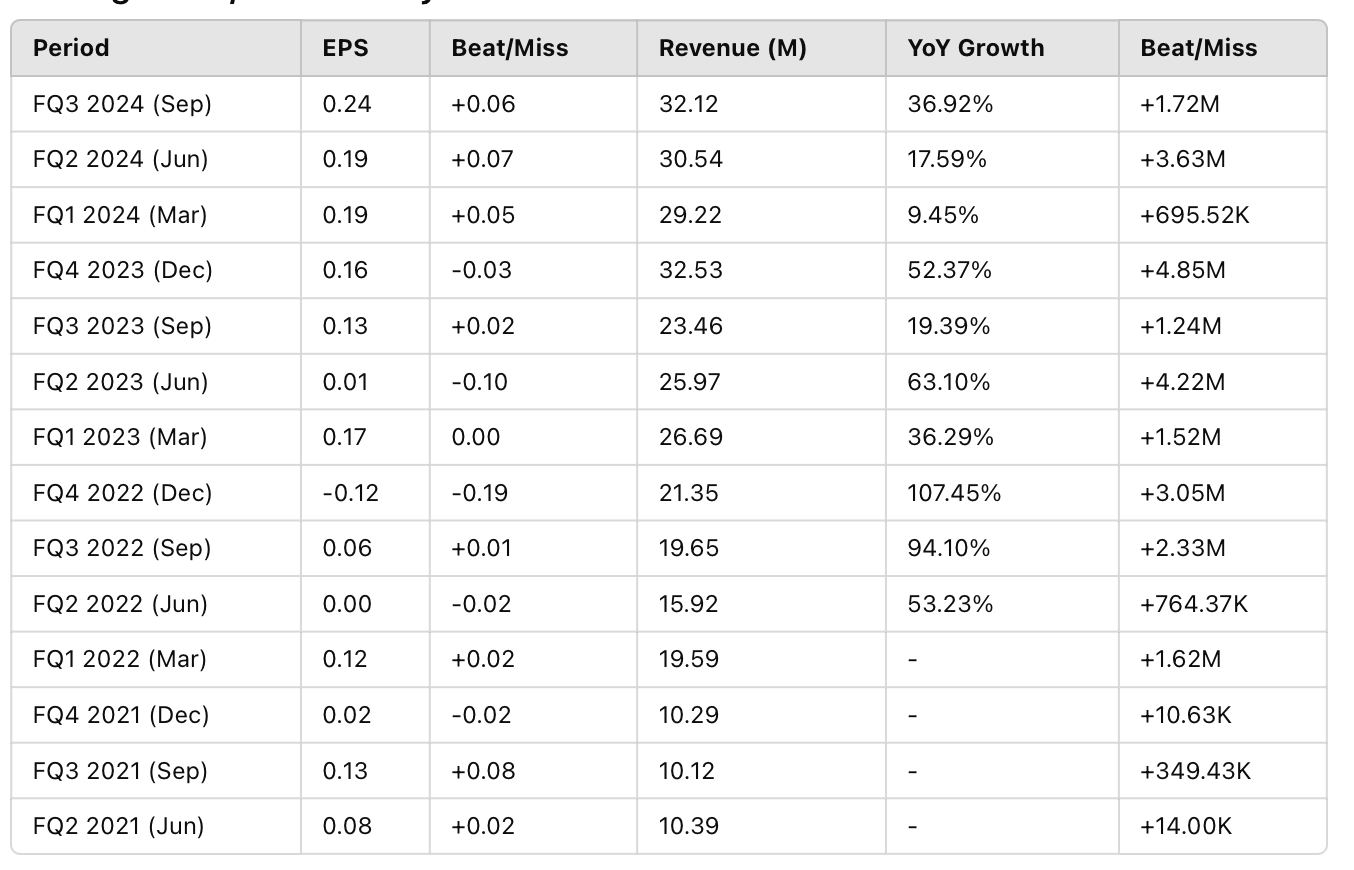

GAMB has demonstrated consistent revenue and earnings growth, significantly outperforming sector peers. Below is a historical breakdown of its financial performance:

Earnings Beat/Miss History

Key Financial Takeaways

EPS has beaten estimates in 9 of the last 12 quarters, indicating strong execution.

Revenue consistently outperforms expectations, driven by strong market share gains and strategic M&A.

Operating leverage improving, with EBITDA margins expanding to 39% in Q3 2024.

Record free cash flow generation of $14.2M, strengthening financial flexibility.

Technical Analysis & Entry Strategy

The stock is exhibiting strong bullish momentum, with a clear breakout pattern on the chart.

Technical Setup:

Breakout above $16 on high volume, confirming an uptrend.

RSI over 70, indicating strong momentum (potential short-term consolidation expected).

Prior resistance at $13.50-$14.00 now support, confirming higher lows.

200-day SMA at $11.00, showing long-term trend remains bullish.

Entry Recommendation:

Buy above $16, confirming breakout momentum.

Stop-loss: $13.80 (below prior resistance turned support).

Target: $25, based on earnings momentum and historical breakout patterns.

Conclusion: Why GAMB is a Strong Buy

Gambling.com Group represents a compelling investment opportunity, combining strong financial fundamentals, high-margin growth, and strategic market positioning.

Investment Thesis Summary:

Market leader in performance marketing for iGaming and online sports betting.

Consistent double-digit revenue growth with expanding margins.

Scalable business model with minimal capital expenditures.

Strong balance sheet with increasing free cash flow and share repurchases.

Bullish technical setup, with 30%+ upside potential.

We initiate coverage with a Strong Buy rating and a $25 price target, reflecting a 30-40% upside from current levels.